6.10

Step 10: Stay Committed to Your Plan >>> Last but not least, remember that investing is a long-term endeavor. It’s crucial to avoid making impulsive decisions based on short-term market fluctuations. Instead, remain focused on your investment strategy and long-term goals. Commitment and patience are key to achieving financial success. By sticking to your plan, […]

6.9

Step 9: Continue Educating Yourself It is important to remember that investing is an ongoing learning process. Stay informed about market trends, financial news, and investment strategies by exploring books, enrolling in courses, listening to insightful podcasts, and following reputable financial news sources. Additionally, consider following topics of interest that you are passionate about, such […]

6.8

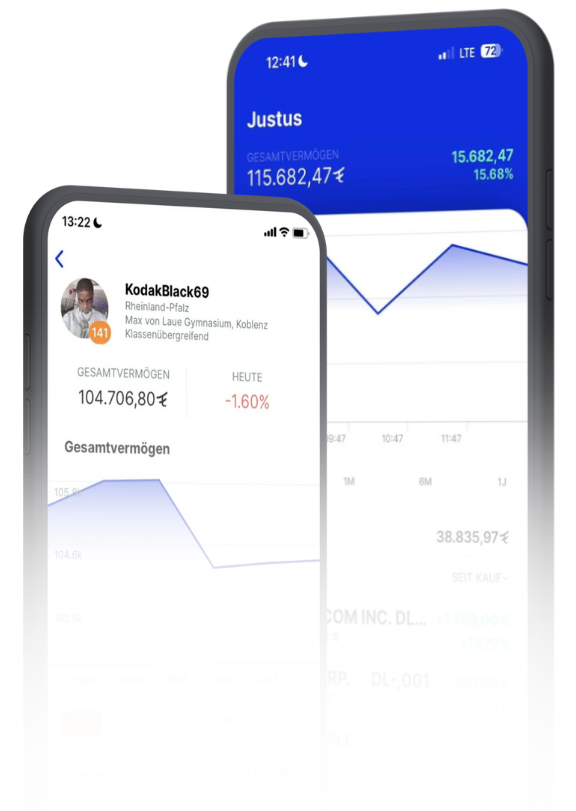

Step 8: Monitor and Rebalance Your Portfolio Regularly reviewing and rebalancing your portfolio is crucial for maintaining a healthy investment strategy. As market conditions change, the value of your investments will fluctuate, potentially shifting your portfolio away from its target asset allocation. To ensure your investments continue to align with your financial goals and risk […]

6.7

Step 7: Diversify Your Portfolio Diversification is a cornerstone of smart investing. By spreading your investments across various asset classes—such as stocks, bonds, and real estate—and different sectors and regions, you reduce the risk of significant losses from any single investment or market downturn. Think of it as not putting all your eggs in one […]

6.6

Step 6: Start Investing Regularly Embarking on your investment journey with a consistent strategy is key to long-term success. One effective method is cost averaging. This means you invest a fixed amount at regular intervals, regardless of how the market is performing. Whether the market is up, down, or flat, you stick to your plan. […]

6.5

Step 5: Choose the Right Investment Accounts Choosing the right accounts for your investments is an important step in your financial journey. For general investing, brokerage accounts provide flexibility but come with different tax implications and withdrawal rules. Understanding the nuances of each account type will help you make informed decisions that align with your […]

6.4

Step 4: Determine Your Risk Tolerance Understanding your risk tolerance is crucial in shaping your investment strategy. Assess how much risk you are willing to take based on your financial situation and investment goals. By aligning your investments with your risk tolerance, you can create a balanced portfolio that suits your financial aspirations and comfort […]

6.3

Step 3: Define Your Investment Goals Clearly outlining your investment objectives is a crucial step in shaping your investment strategy. Determine whether you are saving for retirement, purchasing a home, funding education, planning for a vacation or a gap year, or achieving another financial milestone. Knowing your specific goals will help you tailor your investment […]

6.2

Step 2: Build an Emergency Fund Before diving into investing, it’s essential to establish an emergency fund that covers 3-6 months of your living expenses. This fund acts as a financial safety net, ensuring you are prepared for unexpected expenses such as medical emergencies or sudden job loss. By having this cushion, you can avoid […]

6.1

How to Prepare Oneself? Step 1: Review Your Financial Situation To begin your investment journey, it’s crucial to review your financial situation. Start by evaluating your current financial status, including your income, expenses, and existing savings. This assessment will help you understand how much you can afford to invest without compromising your financial stability. By […]