How to Prepare Oneself? Step 1: Review Your Financial Situation

To begin your investment journey, it’s crucial to review your financial situation. Start by evaluating your current financial status, including your income, expenses, and existing savings. This assessment will help you understand how much you can afford to invest without compromising your financial stability. By having a clear picture of your finances, you can make informed decisions and set realistic investment goals.

Here’s how you can do it:

Choose Your Method: Decide whether you prefer a traditional paper notebook or a digital tool like a spreadsheet or a finance app.

Track Your Expenses: For a month, record every expense you make, no matter how small. This includes bills, groceries, entertainment, and any other spending.

Categorize Your Spending: Group your expenses into categories such as housing, food, transportation, entertainment, and savings.

Analyze Your Data: At the end of the month, review your spending patterns. Identify areas where you can cut back and allocate more towards savings or investments.

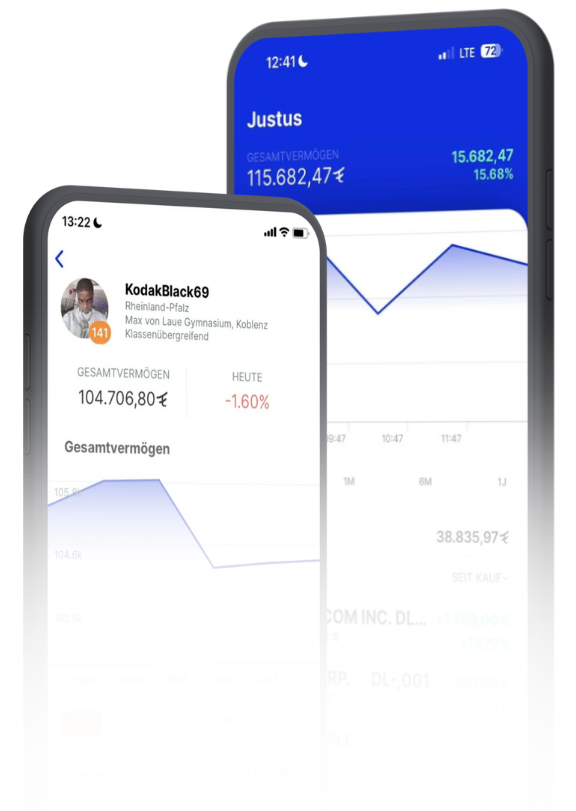

You may also think of consulting the Finanzguru application (this is our voluntary recommendation):

This tool was designed to help users take control of their finances. For beginners, it offers an intuitive platform where you can link all your bank accounts, track your income and expenses, and manage your bills and contracts in one place. The app also calculates your disposable income in real-time, helping you understand your financial situation better and plan your savings more effectively. Additionally, Finanzguru provides insights into your spending habits and future financial commitments, making it easier to stay ahead of your expenses and make informed financial decisions.

Link to the platform: https://finanzguru.de/

You can also access Finanzrechner from Finanzfluss to make the necessarilyy calculations by yourself with the assistance of their diverse tools.