Non-financial information in the Next Generation Investment Challenge

You might have already heard that our new version of the game now includes some non-financial information kindly provided by ISS STOXX. Specifically, in the game application (which you can download here…), you will find a list of financial products to base your investment decisions on. Among these, certain products are marked with a special label , indicating they have been rated by ISS ESG. Both stocks and funds can have these ratings. While not all products currently have such ratings, we are actively working with our partners to expand this coverage.

In the game environment, you can choose which products to invest in. When making these decisions, we recommend considering not only the financial potential of your investments but also the ESG footprint of your choices and, ultimately, your entire portfolio, since this will influence your final performance score.

Your ESG portfolio score is calculated as a time-weighted average. Here’s how it works:

ESG portfolio score (time-weighted ESG Score) = ∑(investment amount * ESG rating of an asset * holding time) / ∑(holding time * investment amount)

The factors influencing the score are:

- Investment Amount: A larger investment in a higher-ranked ESG product generally has a greater positive impact on the overall score.

- ESG Rating: Higher ESG ratings contribute positively to the score.

- Holding Time: Longer holding times can increase the impact of an asset on the score. That means, if you suddenly decide to change your investment strategy completely, your previous decisions will still leave a mark on the score.

Let’s dive into an example:

Portfolio 1 (ETF only)

- ESG rating: 80

- Holding time: 1,000 seconds

- Investment amount: $1,000

- Time-weighted ESG Score: (80 * 1,000 * 1,000) / (1,000 * 1,000) = 80

Portfolio 2 (ETF and stock)

- Asset 1 (ETF): ESG rating = 80, Holding time = 3,600 seconds (total holding time), Investment amount = $1,000

- Asset 2 (Stock): ESG rating = 60, Holding time = 3,600 seconds, Investment amount = $300

- Time-weighted ESG Score: ((80 * 3,600 * 1,000) + (60 * 3,600 * 300)) / ((3,600 * 1,000) + (3,600 * 300)) ≈ 75.38

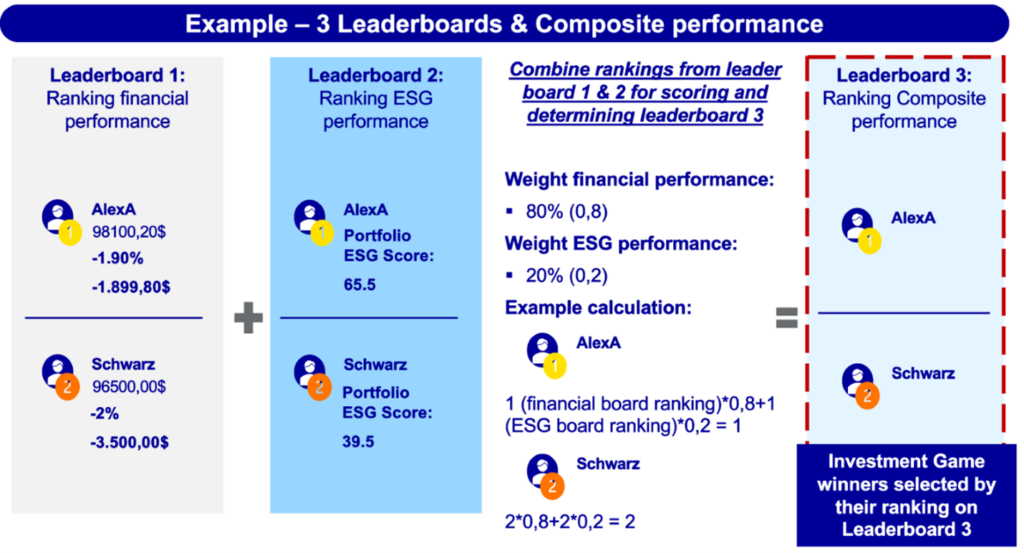

In the game, you will see three leaderboards. There, you can see your ranking among your peers.

- The first leaderboard depicts the pure financial performance of your portfolio, in other words, the return on investments you made.

- The second leaderboard shows the ranking of your portfolio based on its ESG performance, which is constantly assessed based on the formula above.

- The third leaderboard is the final composite leaderboard, where you see your ranking based on a combined score from the other two leaderboards. The higher you are on this leaderboard, the better your consolidated performance is.

How to Improve Your Rankings:

- Financial Performance: To climb the financial performance leaderboard, focus on making smart investment choices that yield high returns. Keep an eye on market trends, diversify your portfolio, and manage risks effectively.

- ESG Performance: To improve your ESG ranking, select investments that score high on environmental, social, and governance criteria. Research companies and funds that are committed to sustainability and ethical practices.

- Composite Score: Your position on the composite leaderboard reflects your overall success in balancing financial returns with ESG impact. Strive to achieve a strong performance in both areas to maximize your composite score.

Please note that the distribution of weight for the first leaderboard is 80%, while the second leaderboard ranking contributes 20%. By focusing on both financial returns and ESG impact, you can achieve a well-rounded and successful investment strategy. Our platform is a risk-free and safe space. Therefore, we encourage you to experiment, observe and stay informed: regularly check the updates to stay informed about market conditions and new investment opportunities and do not forget to regularly review your portfolio’s performance and make adjustments as needed to optimize both financial and ESG outcomes.