Is Investing Gambling?

Unlike gambling, investing involves analyzing data and trends to make informed decisions. Do not worry; you do not necessarily need to deeply analyze each stock. Investing, even without extensive analysis, is better than doing nothing. Unlike a savings account, the value of stocks and bonds can go down. However, your savings account will lose value, buying power, due to inflation. But you can manage these risks by investing for a long time and spreading your money across different types of investments and keeping the costs low.

Aspects you should consider:

1: Time plays a role

Your investment time horizon is how long you plan to invest to reach your financial goals. It can be months, years, or even decades. When planning your investments, think about how much risk you can handle. If you have a long time to invest, you might like to take more risks because you have time to recover from any losses. For short-term goals, you need investments that you can easily turn into cash and that are not as volatile.

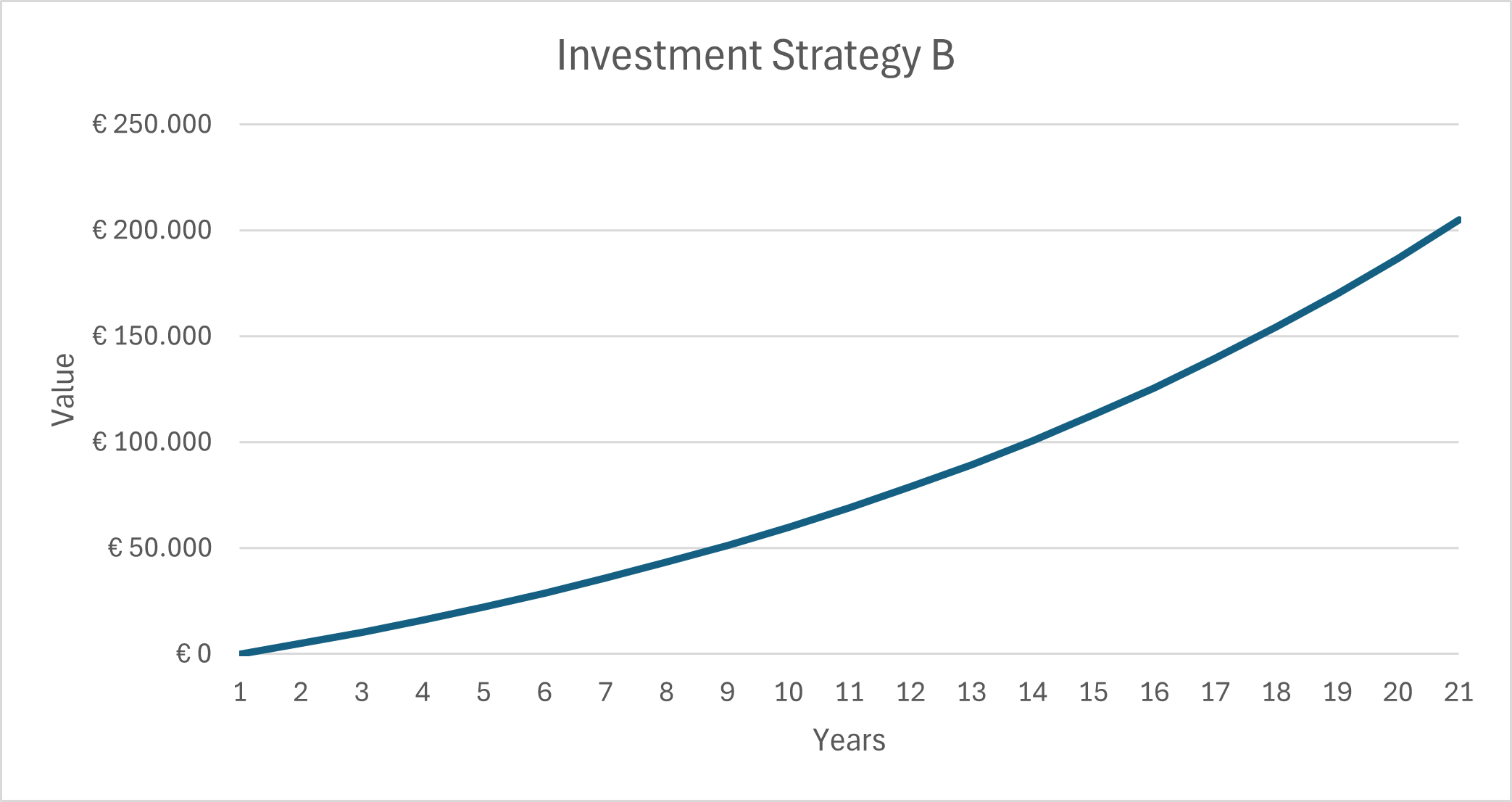

You might also encounter the collocation “the effect of compounding” quite often. It is like a snowball rolling down a hill, getting bigger and bigger as it goes. When your investment earns money, and then that money earns more money, you get a powerful growth effect over time.

Examples of Compounding

Scenario A: If you invest $5,000 every year at a 7% return for 30 years, you’ll end up with about $472,000 thanks to compounding.

Scenario B: If you invest the same amount for 20 years, you’ll have around $219,000.

Difference: Those extra 10 years nearly double your money, showing why starting early makes a difference.